Amazon sellers need specialized accounting software to manage their finances, track inventory, and streamline operations. With so many new sellers entering the e-commerce market, it is important to find quality accounting software that meets their needs.

Several options are available for Amazon FBA sellers to help them track inventory and manage their finances. With the right tools, you can focus on growing your business while your accounting processes run smoothly in the background.

This guide presents Amazon sellers’ top accounting software options in 2026, examining their features, pricing, and suitability for different business sizes.

Do I Need Accounting Software For My Small Amazon Business?

Accounting software can be a great asset for any small Amazon business. It can help keep track of your finances and ensure everything is running smoothly. This software can also save you time by automating some of the more tedious accounting tasks and allowing you to focus on other aspects of your business.

Accounting software can also help you comply with tax laws, so it’s important to consider whether it would benefit your business.

Ultimately, it comes down to whether or not the features and benefits offered by accounting software are worth the cost for your particular situation.

Comparison Of Top Accounting Software for Amazon Sellers

Accounting software tools like Xero, Helium 10, QuickBooks, and Zoho Books can work for Amazon sellers. The table below will give you more insights.

| Software Name | Starting Price (Annual) | Best For |

|---|---|---|

| Xero | $24/year ($2/mo) | Multi-channel integration |

| Helium 10 | $348/year ($29/mo) | All-in-one seller solution |

| QuickBooks Online | $39/year ($3.50/mo promo) | Tax management |

| A2X | $228/year ($19/mo) | Settlement reconciliation |

| FreshBooks | $126/year ($10.50/mo) | Invoice automation |

| AccountingSuite | $199/year ($19/mo) | Inventory tracking |

| Zoho Books | $15/month/ year | Small business budgeting |

| Sage Business Cloud | $625/ user/ year | Scalable accounting |

After deep market research, I have prepared this list of some of the best Amazon accounting software based on functionality, ease of use, and price. So, let’s analyze how each one performs.

1. Xero

Xero is one of small and medium businesses’ most prominent accounting tools. Forbes has awarded the platform twice as the World’s Most Innovative Growth Company. It’s a cloud-based service that you can use from anywhere, anytime, to see your billing details and other accounting and financial details in real-time.

In addition, the company provides its services in markets Australia, New Zealand, and the United Kingdom and is handling over 1.8 million Amazon sellers worldwide.

Xero Features:

Check out some of the key features of Xero:

- Can integrate with multiple platforms and applications such as A2X, Shopify, Stitch Labs, etc, to provide you with a customized Amazon business experience.

- Provides you with instant, up-to-date financial and transaction reports.

- Helps you prepare and send invoices.

- Tax report organization and online filing.

- Allows you to connect with your bank and make online transactions quicker and easier.

- User-friendly interface with a variety of add-on support.

Xero Pricing Information:

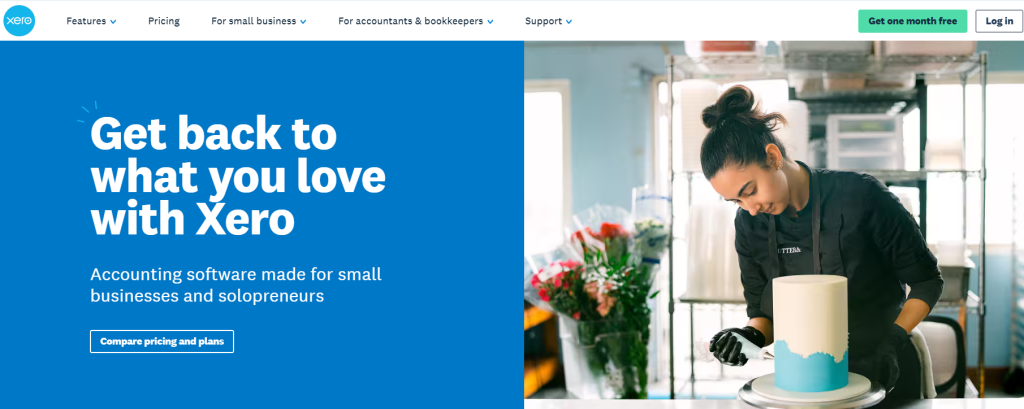

Xero offers three plans for its customers: Early, Growing, and Established. Each plan comes with a month’s free trial.

- Early plan: $2/month (normally $20) – Create 5 quotes and invoices, enter 5 bills, reconcile 20 bank transactions.

- Growing plan: $4.70/month (normally $47) – Unlimited invoices and quotes, unlimited bill generation and bank reconciliations.

- Established plan: $8/month (normally $80) – All Growing features plus multi-currency support and short-term cash flow overview.

2. Helium 10

Note: To get more details on Helium 10, check out our Helium 10 Review here.

Helium 10 offers a complete seller toolkit for Amazon FBA businesses, with Helium 10 Profits focusing on financial performance tracking. The platform provides features from listing optimization to sales tax tracking and more.

Not only does it organize your finances, but it also provides several sub-tools for increasing your sales by applying various marketing techniques. The software is designed to manage a small business and a well-established organization. The program features a simplified interface; you don’t need any prior technical or accounting knowledge to navigate it.

Features

Check what’s included in this software.

- Centralized dashboard to track profit, expenses, and sales.

- Cost estimation tools to maximize profit margins

- Inventory management and protection.

- User-friendly interface requiring no technical accounting knowledge.

- Online training and one-to-one sessions to address your queries.

Pricing Information

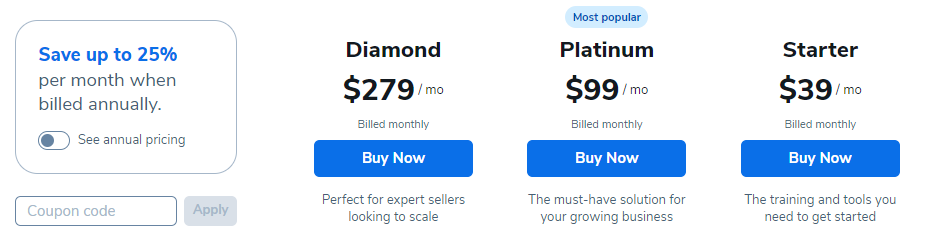

There are 4 plans available for Helium 10 – Starter, Platinum, Diamond, and Elite

- The starter plan costs $39/month and comes with full access to the financial analytics tool.

- The platinum plan costs $99/month and comes with some additional features, including 2000 automated customer emails every month. This plan also gives you full access to the Helium 10 Profit.

- The diamond plan costs $279/month and comes with a multi-user login facility, access to a profit analytics tool, and full access to Walmart marketplace tools.

3. QuickBooks Online

Quickbooks is designed to help small Amazon businesses with sales management and financial reports. The platform is widely known for helping users with their tax calculations and deductions for Amazon sales. The software also helps you with invoice customization, sending, stock tracking, purchasing, payroll, and more.

The platform is fairly easy to navigate and doesn’t require an accounting background. Furthermore, the tool helps you analyze your sales activities, potential opportunities, or even inventory across various warehouses.

Quickbooks Features:

Here are some attractive features of QuickBooks Online

- Allows you to monitor the expenses and income over a certain time duration.

- Automatically calculates your sales tax and deductions related to your Amazon business.

- Video tutorials and online assistance are available to help you understand the platform and its operation.

- Synchronizes perfectly with your multiple bank accounts and can be accessed through a mobile phone.

- Inventory management assistance helps you track your inventory throughout the sale.

- An effective payroll and employee management system to streamline your salary distribution.

Quickbooks Pricing Information:

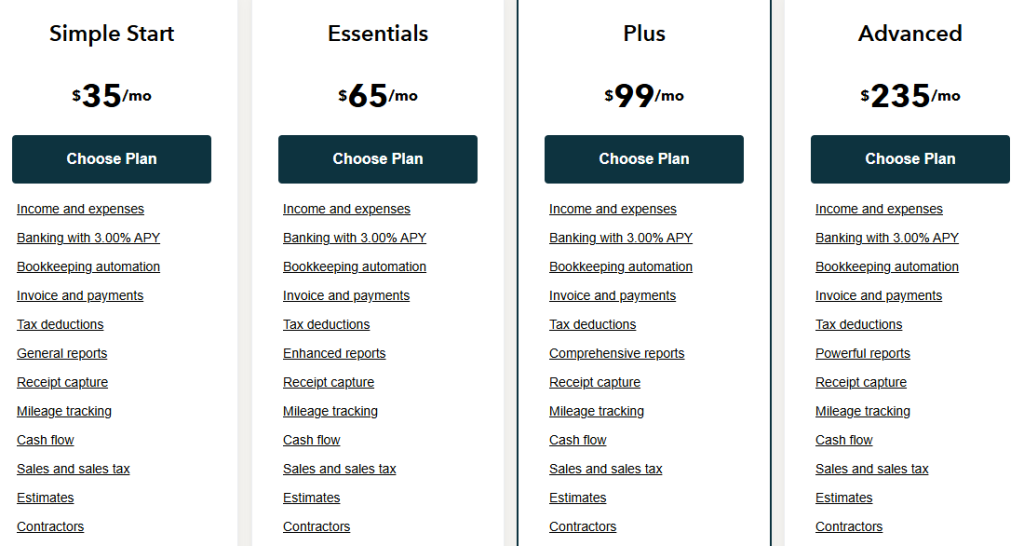

Quickbooks Online provides 4 basic plans for its users – Simple Start, Essentials, Plus, and Advanced.

- Simple Start: $3.50/month (promotional) – Essential bookkeeping, income tracking, invoicing, and payment options.

- Essentials: $6.50/month (promotional) – Adds bill management and 3-user support.

- Plus: $9.90/month (promotional) – Adds inventory and profitability tracking with 5-user support.

- Advanced: $23.50/month (promotional) – Complete solution with employee payroll, app integrations, and a dedicated accounting team.

4. A2X

A2x is a cloud-based accounting system that records your Amazon business transactions. The tool can be easily integrated with other popular accounting platforms such as Shopify, Xero, and QuickBooks, and send sales data from different channels to your accounting platform.

You also get detailed monthly financial reports, including your sales and expenses, profit margin, tax deductions, and inventory details such as total inventory value and the cost of sold items.

A2X Features:

Here are some key highlights of the A2X accounting system:

- Let you connect with accounting experts from all over the world to address your queries.

- Integrates with tax computing companies and allows you to accurately monitor your tax deductions.

- Easy monthly fulfillment reports, including inventory data such as availability, value, and location.

- A detailed comparison between the goods’ values and sales performance to assess your profit.

- Migrates accounting information from various platforms to one centralized platform.

- Access to customer care and various Accounting communities.

A2X Pricing Information:

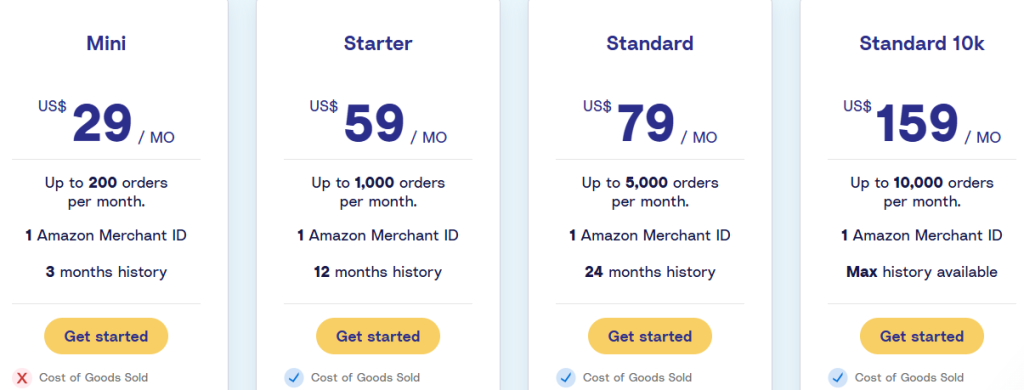

A2X has 4 basic premium plans – Mini, Starter, Standard, and Standard 10k. The plans are based on the number of orders you generate each month. So let’s have a look.

- Mini: $29/month – Up to 200 orders per month, 3 months history, Amazon Pay reconciliation, email & live chat support.

- Starter: $59/month – Up to 1,000 orders per month, 1 Amazon Merchant ID, 12 months history, Cost of Goods Sold tracking, FBA inventory locations.

- Standard: $79/month – Up to 5,000 orders per month, 24 months history, all Starter features with more order capacity.

- Standard 10k: $159/month – Up to 10,000 monthly orders, 1 Amazon Merchant ID, maximum available history, premium 1:1 support, and onboarding.

5. FreshBooks

FreshBooks is one of the leading accounting software solutions for small businesses and freelancers. It makes it easy to track your finances, invoices, payments, and more. With FreshBooks, you can quickly create professional-looking invoices that look great on any device.

You can easily manage your business expenses and generate financial reports with just a few clicks. Plus, FreshBooks also allows you to accept payments online, so you don’t have to worry about chasing down late payments from clients.

FreshBooks Features:

Here are some key highlights of FreshBooks:

- Create professional-looking invoices with ease.

- Easily track expenses and generate financial reports.

- Accept payments online quickly and securely.

- Automate recurring billing for regular customers.

- Create estimates to send potential clients a quote for their project costs easily.

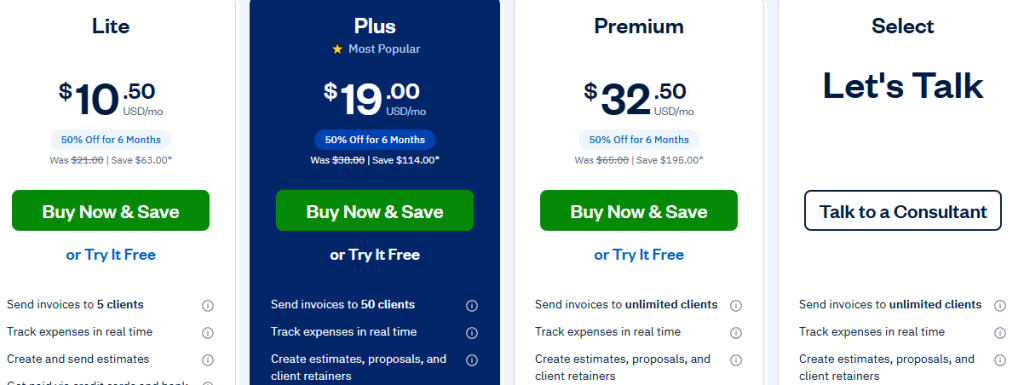

FreshBooks Pricing Information:

FreshBooks has three pricing plans to choose from: Lite, Plus, and Premium. Currently, there is a 50% off for the first 6 months on all plans with a 30-day money-back guarantee.

- Lite: $10.50/month (normally $21) – Send invoices to 5 clients, track expenses, create estimates.

- Plus: $19/month (normally $38) – Send invoices to 50 clients, plus proposals and client retainers.

- Premium: $32.50/month (normally $65) – Unlimited clients, customizable email templates, project profitability analysis.

6. AccountingSuite

AccountingSuite is another good accounting software solution tailored specifically for Amazon sellers and e-commerce businesses. It simplifies financial management, bookkeeping, and reporting.

With AccountingSuite, Amazon sellers can seamlessly connect their Amazon accounts to import and categorize transactions automatically. You can generate customized financial statements with one click.

AccountingSuite Features:

- Auto-import Amazon transactions and reconcile accounts.

- Create professional invoices and track expenses.

- One-click financial statements and inventory reporting.

- Accept online payments through Stripe and PayPal integrations.

- Automate accounting workflows with 100+ app integrations.

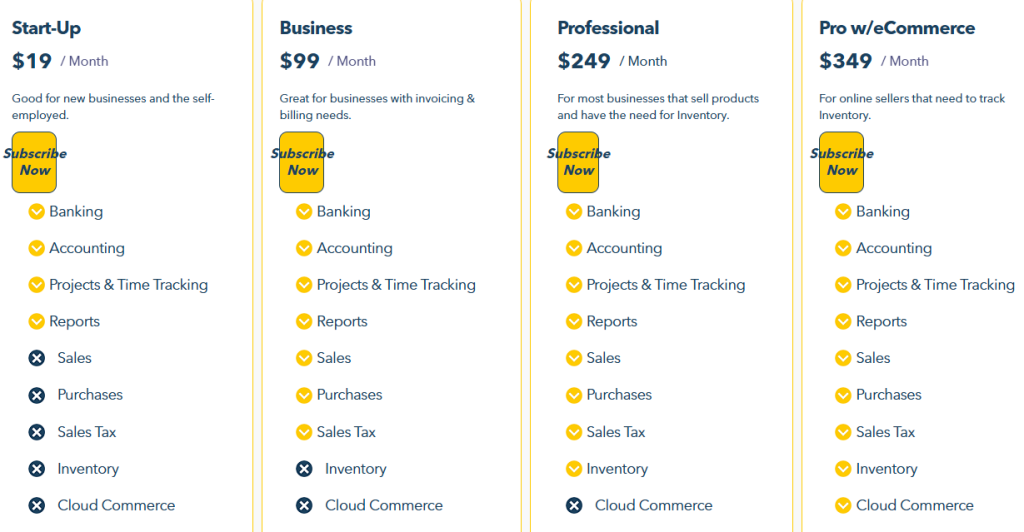

AccountingSuite Pricing Information:

AccountingSuite has four pricing plans: Start-Up, Business, Professional, and Pro w/eCommerce. You can save up to 589 on choosing annual plans.

- Start-Up: $19/month or $199/year – Essential bookkeeping features.

- Business: $99/month or $999/year – Advanced reporting and invoicing tools.

- Professional: $249/month or $2,499/year – Inventory management and dedicated account manager.

- Pro w/eCommerce: $349/month or $3,599/year – Complete ecommerce integration features.

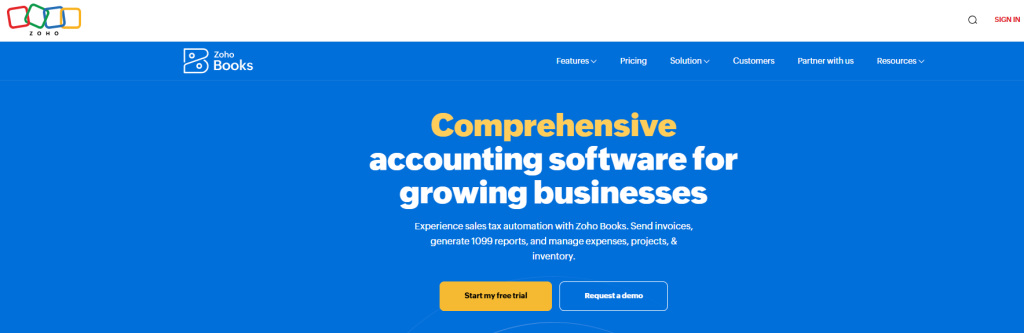

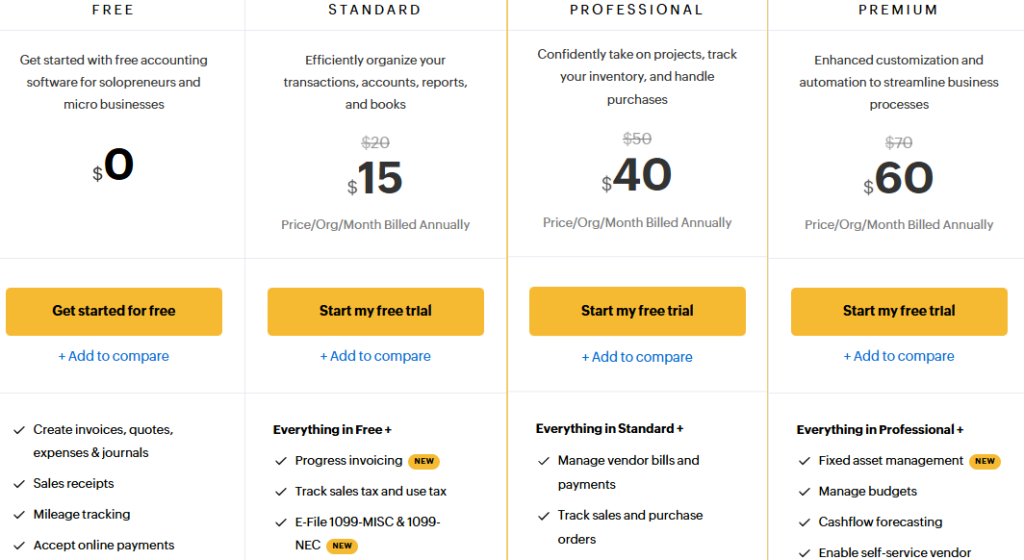

7. Zoho Books

Zoho Books provides Amazon sellers with affordable yet powerful accounting features. This cloud-based system allows for easy management of finances with automatic bank feeds, customizable invoices, and expense tracking.

With options ranging from free plans for solopreneurs to advanced solutions for larger operations, Zoho Books helps Amazon businesses manage finances, track inventory, and streamline tax preparation.

Zoho Features:

Zoho offers various features, including;

- Amazon marketplace integration for automated sales data import.

- Multi-currency support for international sellers.

- Automated bank reconciliation and expense tracking.

- Customizable invoices and payment reminders.

- Inventory tracking with low stock alerts.

- Mobile app accessibility for on-the-go management.

- Self-service customer portal for improved client experience.

Zoho Pricing Information

Zoho Book offers various plans, ranging from free to premium.

- Standard: $13/month billed annually – Basic accounting features for small Amazon stores.

- Professional: $27/month billed annually – Advanced features with vendor portal access.

- Premium: $57/month billed annually – Complete solution with powerful analytics and 10 users.

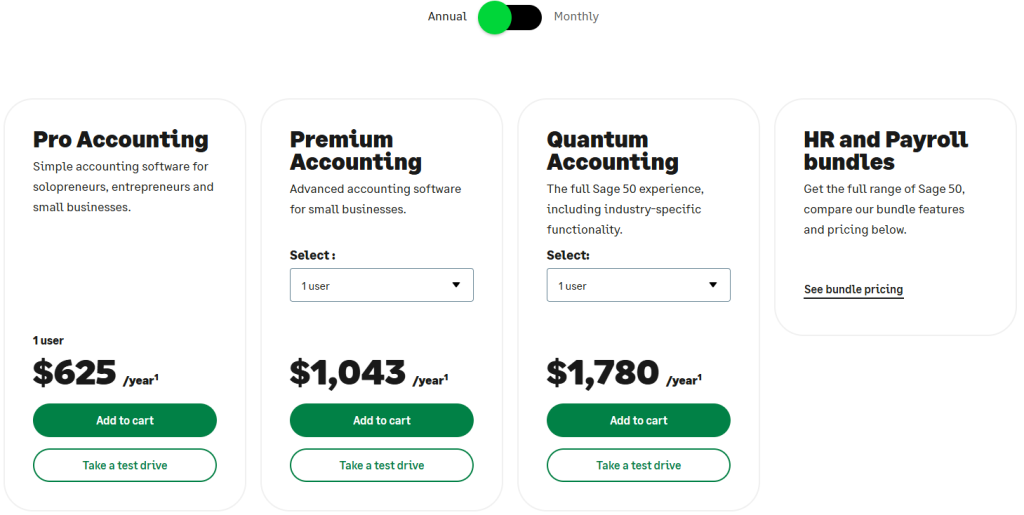

8. Sage

Sage Business Cloud Accounting offers Amazon sellers robust financial management with industry-specific features. With over 40 years of experience serving 2 million customers worldwide, Sage provides AI-powered tools that help sellers track inventory, manage finances, and gain insights for strategic decisions.

The platform scales with your business, offering solutions from basic accounting to complete financial management systems.

Sage Features

Here are the features you will get in Sage 50:

- Amazon marketplace integration for streamlined sales tracking.

- AI-powered analytics provide actionable business insights.

- Automated bank reconciliation and transaction processing.

- Cloud-based access allows management from anywhere.

- Multi-currency support for international Amazon sellers.

- Industry-specific functionality for e-commerce businesses.

Sage Pricing Information

The Sage 50 pricing structure is divided into four plans. Each plan offers features that are one step ahead of the previous pricing plan.

- Pro Accounting: $625/year or $61.92/month – Simple accounting software for solopreneurs and small businesses with basic needs.

- Premium Accounting: $1,043/year or $103.92/month – Advanced accounting software for growing small businesses requiring more features.

- Quantum Accounting: $1,780/year or $177.17/month – The full Sage 50 experience with industry-specific functionality for established sellers.

- Additional HR and Payroll bundles are available for comprehensive business management.

Related Read:

Conclusion: Try The 8 Best Accounting Software for Amazon Sellers

Choosing the right accounting software transforms how Amazon sellers manage their business finances. Your selection should align with your business size, sales volume, and growth plans.

For seller tools, Helium 10 stands out, while AccountingSuite excels for inventory-focused operations. FreshBooks offers intuitive invoicing for service providers, and Xero provides superior multi-channel integration.

New platforms like Zoho Books and Sage deliver excellent value for budget-conscious sellers. Take advantage of free trials before committing to any solution, or you can start with a free plan if the platform offers.

Frequently Asked Questions

Connect your Amazon account with FreshBooks using integration apps like Zapier or A2X. These tools automatically import your sales, fees, and transactions, creating organized entries in your FreshBooks account.

Accounting software helps you track and manage your financial activities and maximize your efforts, saving you time that you can use to increase sales.

Most accounting software offers free trials but requires paid subscriptions for full functionality. Some provide limited free plans, but premium Amazon-specific features require payment.

Depending on the size of your business, you can hire a professional accountant or form an accounting team. The easier and cheaper way is to use Amazon Accounting Software.

This is Wagner, an experienced Amazon FBA expert, and eCommerce enthusiast. With years of experience selling on Amazon, I got a wealth of knowledge to share with fellow sellers. In their writing, I cover a range of topics including Amazon FBA strategies, eCommerce trends, and online retail best practices.