Are you an Amazon seller looking for the best Accounting Software For Amazon Sellers? With so many new sellers entering the ecommerce market, finding quality accounting software that meets your needs is important. Can be difficult

Fortunately, several options are available for Amazon FBA sellers to help them track inventory and manage their finances. In this article, we’ll discuss the five best accounting software for Amazon sellers in 2023.

These include tracking sales channels, managing bank deposits, and recording expenses. Whether you’re a new or experienced seller, these solutions will help you meet your accounting needs while allowing you to focus on growing your business.

Do I need accounting software for my small Amazon business?

Accounting software can be a great asset for any small Amazon business. It can help keep track of your finances and ensure everything is running smoothly. This software can also save you time by automating some of the more tedious accounting tasks and allowing you to focus on other aspects of your business.

Accounting software can also help you stay compliant with tax laws, so it’s important to consider if this would benefit your business.

Ultimately, it comes down to whether or not the features and benefits offered by accounting software are worth the cost for your particular situation.

What is Accounting Software for Amazon Sellers?

Amazon accounting software consists of a set of tools that help you streamline the process of billing, taxation, invoicing, and so on.

When running a business on Amazon on a large scale, it’s impossible to single-handedly manage all the operations related to sales, accounting, product listing, marketing, advertising, etc. As far as accounting is concerned, most established seller relies on accounting software.

Here are some of the common features of Amazon accounting software:

- Generating monthly transactions and financial reports

- Generating and sending invoices

- Some software also provides inventory management to keep your profit in check

- Tax calculations

- Payroll and employee management

7 Best Accounting Software For Amazon Sellers

After deep market research, I have prepared this list of some of the best Amazon accounting software based on their functionality, ease of use, and price. So let’s try to analyze how each one performs.

1. Xero

Found in 2006, Xero is one of the most prominent accounting tools for small and medium businesses. Forbes has awarded the platform twice as World’s Most Innovative Growth Company. It’s a cloud-based service that you can use from anywhere, anytime, to see your billing details and other accounting and other financial details in real-time.

In addition, the company provides its services in markets Australia, New Zealand, and the United Kingdom and is handling over 1.8 million Amazon sellers worldwide.

Features:

Check out some of the key features of Xero:

- Can integrate with multiple platforms and applications such as A2X, Shopify, Stitch Labs, etc to provide you with a customized Amazon business experience

- Provides you with instant up-to-date financial and transaction reports

- Helps you prepare and send invoices

- One of the best tools to organize your tax reports and for online filing

- Allows you to connect with your bank and make online transactions quicker and easier

- User-friendly interface with a variety of Add-ons support

Pricing Information:

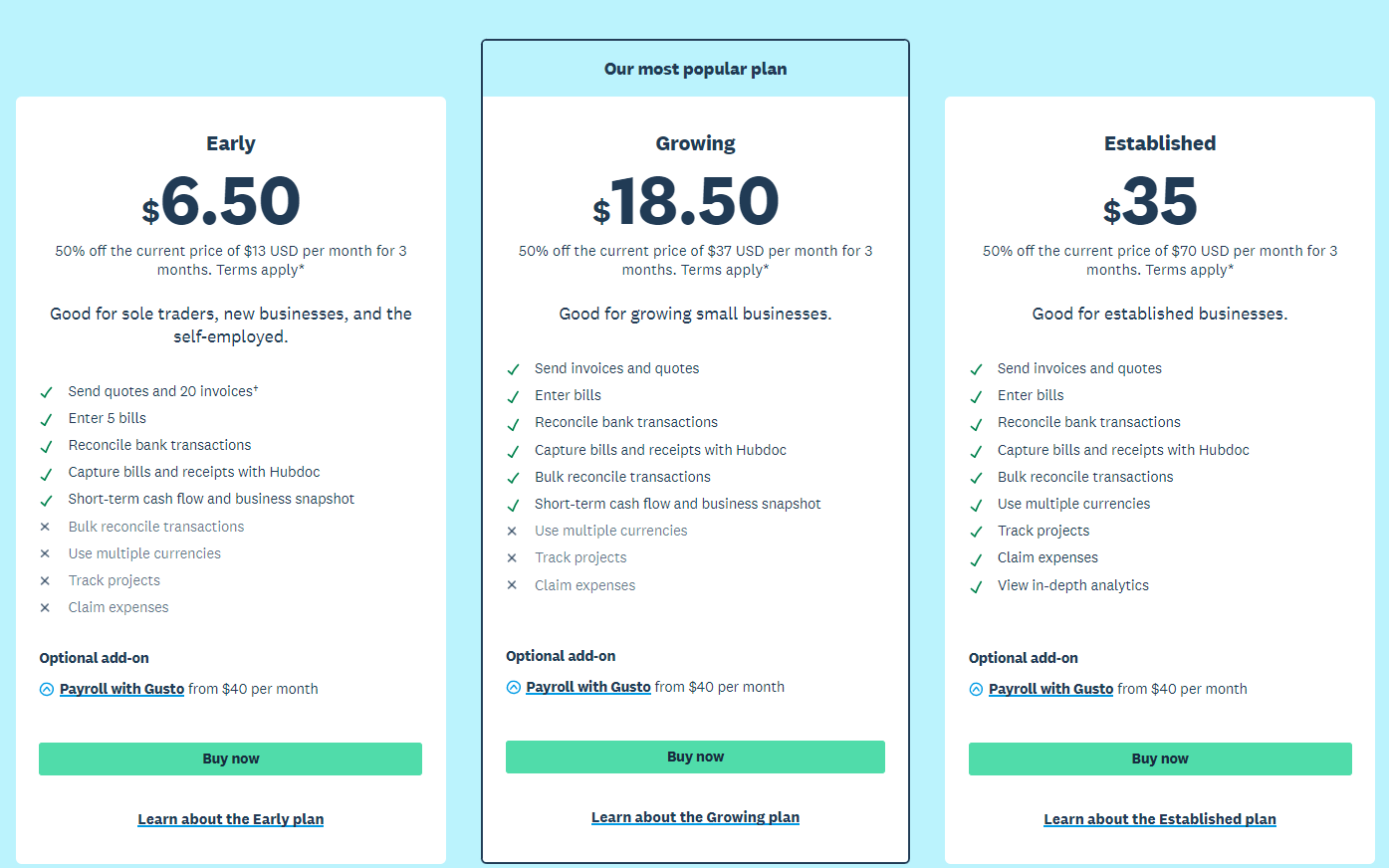

Xero has 3 plans for its customers – Early, Growing, and Establish, all of which come with a month of a free trial.

- The early plan costs you $6.50/month and allows you to create and send 5 quotes and invoices. You also get to enter 5 bills and reconcile 20 bank transactions.

- The growing plan costs you $18.50/month and comes with unlimited invoices and quotes. There is no limit on bill generation as well as reconciling bank transitions.

- An established plan is more suitable for a well-settled business. It costs $35/month and gives you unlimited invoices and quotes, as well as the reconciliation of bank transfers. There is also multi-currency support and an overview of your short-term cash flow.

2. Helium 10 – Profits

Note: To get more details on Helium 10, check out our Helium 10 Review here.

Helium 10 is the complete seller tool for your FBA business, and Helium 10 – Profit shows your overall financial performance. The platform is as versatile as it gets offering you great features from listing optimization to sales tax tracking and much more.

Not only does it organize your finances, but it also provides a bunch of sub-tools to increase your sales by applying various marketing techniques.

The software is designed to manage a small business and a well-established organization. The program features a simplified interface; you don’t need any prior technical or accounting knowledge to navigate it.

Other features, such as keyword research, inventory management, profit and expense estimation, tax manager, etc., are available.

Features

- Centralized dashboard to track profit, expenses, and sales

- Cost estimation in order to maximize the profit

- Inventory management and protection

- User-friendly interface

- Online training and one-to-one sessions to address your queries

Pricing Information

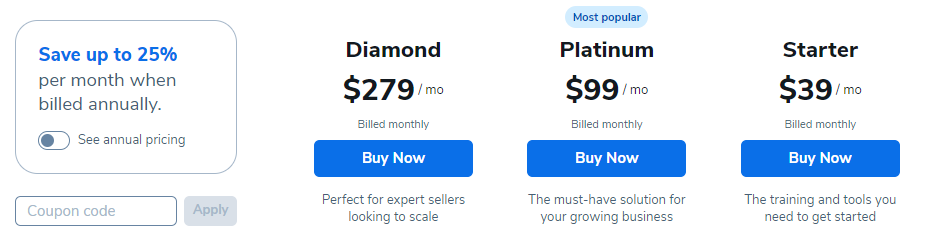

There are 4 plans available for Helium 10 – Starter, Platinum, Diamond, and Elite

The starter plan costs $39/month and comes with full access to the financial analytics tool

The platinum plan costs $99/month and comes with some additional features, including 2000 automated customer emails every month. This plan also gives you full access to the Helium 10 Profit.

The diamond plan costs $279/month and comes with a multi-user login facility along with access to a profit analytics tool. You also get full access to Walmart marketplace tools.

The elite plan is more suitable for sellers looking to scale their businesses rapidly. It costs $399/month and gives you access to the private Facebook group as well as quarterly workshops and training with marketing experts.

3. Quickbooks Online

Quickbooks is designed to help small Amazon businesses with sales management and financial reports. The platform is widely known for helping users with their tax calculations and deductions for Amazon sales. The software also helps you with invoice customization, sending, stock tracking, purchasing, payroll, and more.

The platform is fairly easy to navigate and doesn’t need an accounting background. Furthermore, the tool also helps you analyze your sales activities, potential opportunities, or even the inventory across various warehouses.

Features:

Here are some attractive features of Quickbooks Online

- Allows you to monitor the expense and income between a certain time duration

- Automatically calculates your sales tax and deductions related to your Amazon business

- It can be used offline as well

- Video tutorials and online assistance to help you understand the platform and its operation

- Synchronizes perfectly with your multiple bank accounts and can be accessed through mobile phone

- Inventory management assistance helps you track your inventory throughout the sale.

- An effective payroll and employee management system to streamline your salary distribution

Pricing Information:

Quickbooks Online provides 4 basic plans for its users – Simple Start, Essentials, Plus, and Advanced.

A simple plan, a single-user license costs $12.50/month and gives you access to almost all the premium features such as income and expenses tracking, payment and invoice, tax assistance, etc.

The essentials plan costs $25/month and gives you access to all the premium services along with 3-user license support and the ability to manage and pay the bills.

Plus plan costs you $40/month with the added support of 5 users along with inventory and profitability tracking.

An advanced plan is more suitable for medium-big organizations. It comes with 5+ user license support. The plan costs $90/month and has great benefits such as employee payroll management, app integrations, a dedicated accounting team, online training, and much more.

4. A2X

A2x is a cloud-based accounting system that records your Amazon business transactions. The tool can be easily integrated with other popular accounting platforms such as Shopify, Xero, and Quickbooks and send sales data from different channels to your accounting platform.

You also get detailed monthly financial reports, including your sales and expense, profit margin, tax deductions, and inventory details such as total inventory value and the cost of sold items.

Features:

Here are some key highlights of the A2X accounting system:

- Let you connect with accounting experts from all over the world to address your queries

- Integrates with tax computing companies and allows you to keep an eye on your tax deductions with high accuracy

- Easy monthly fulfillment reports, including inventory data such as availability, value, and location

- A detailed comparison between the goods values and sales performance to let assess your profit

- MIgrates accounting information from various platforms to one centralized platform

- Access to customer care and various Accounting communities

Pricing Information:

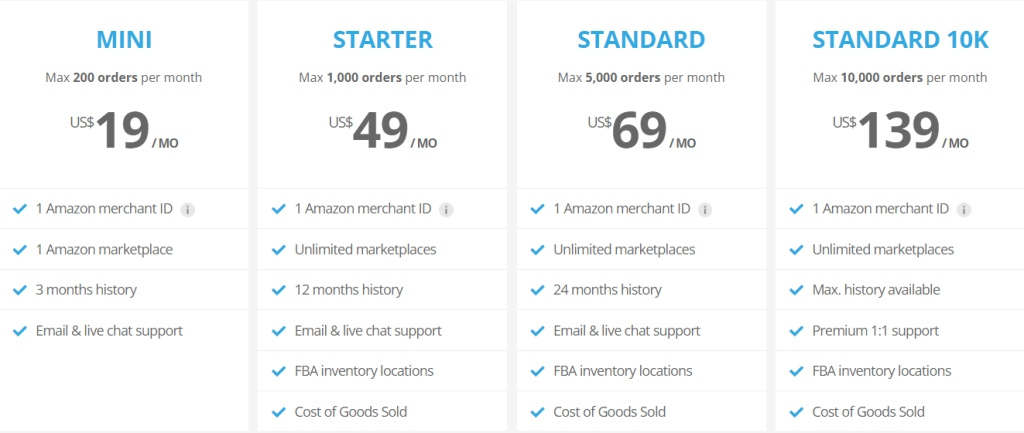

A2X has 4 basic premium plans – Mini, Starter, Standard, and Standard 10k. The plans are based on the number of orders you generate each month. So let’s have a look.

The mini plan costs $19/month and comes with the following benefits

- Supports a single Amazon seller ID and a single Amazon Marketplace

- Lets you retrieve up to 3 months of Amazon settlement history

- Customer support through email and chat

The starter plan costs $49/month with few additional features to the Mini plan

- 1 Amazon merchant ID and Unlimited marketplace support

- Inventory locations for your FBA business

- Cost estimation of sold inventory

- Up to 12 months of settlement history

The standard plan is the most popular one, which costs you $69/month.

- Up to 24 months of Amazon settlement history

- Single Amazon seller ID and unlimited marketplaces support

- Email and live chat support

- Inventory locations and cost estimation

A standard 10k account is more suitable for sellers with a huge amount of monthly orders. The plan costs $139/month and comes with the following benefits

- Maximum transaction history from Amazon

- Premium one-to-one support for your queries

- Inventory management and cost estimation

5. GoDaddy Online Bookkeeping

Previously named Outright, the GoDaddy Online Bookkeeping is one of the most affordable accounting assistants you can get. Recently acquired by a popular domain name seller Godaddy, the platform is available for online use only. However, it has an extremely simple user interface, perfect for beginners or sellers with no accounting background.

The bookkeeping platform provides useful tools such as tax support, expense analysis, and integration with e-commerce websites.

Although the tool lacks important features like bank reconciliation, it offers good customer privacy and data security. If you want to expand your online business, try Godaddy Online Bookkeeping.

Features:

- Allows you to prepare customized invoices, then send and track them

- Provides you with your net profit or loss on a single view with a few clicks

- Brilliantly works with Tax deductions

- It keeps a record of your monthly financial activities, such as payments, expenses, and income.

- Very affordable plans, suitable for freelancers

Pricing Information:

GoDaddy bookkeeping offers 3 premium plans for its customers – Get Paid, Essentials, and Premium.

Get Paid plan costs $5/month with the following features:

- Invoicing and cost estimation

- Payment retrieval from credit/debit cards

- Time tracking

The essentials plan will cost you $10/month. Let’s have a look at the services covered in this plan:

- Retrieve sales data from e-commerce websites

- Tax worksheets

- Unlimited financial reports

- Syncing with your bank account

The premium plan offers everything from Get Paid and Essential Plan, along with the recurring invoice feature. The premium plan costs you only $15/month.

6. FreshBooks

FreshBooks is one of the leading accounting software solutions for small businesses and freelancers. It makes it easy to track your finances, invoices, payments, and more. With FreshBooks, you can quickly create professional-looking invoices that look great on any device.

you can easily manage your business expenses and generate financial reports with just a few clicks. Plus, FreshBooks also allows you to accept payments online, so you don’t have to worry about chasing down late payments from clients.

Features:

Here are some key highlights of FreshBooks:

- Create professional-looking invoices with ease

- Easily track expenses and generate financial reports

- Accept payments online quickly and securely

- Automate recurring billing for regular customers

- Create estimates to send potential clients a quote for their project costs easily

Pricing Information:

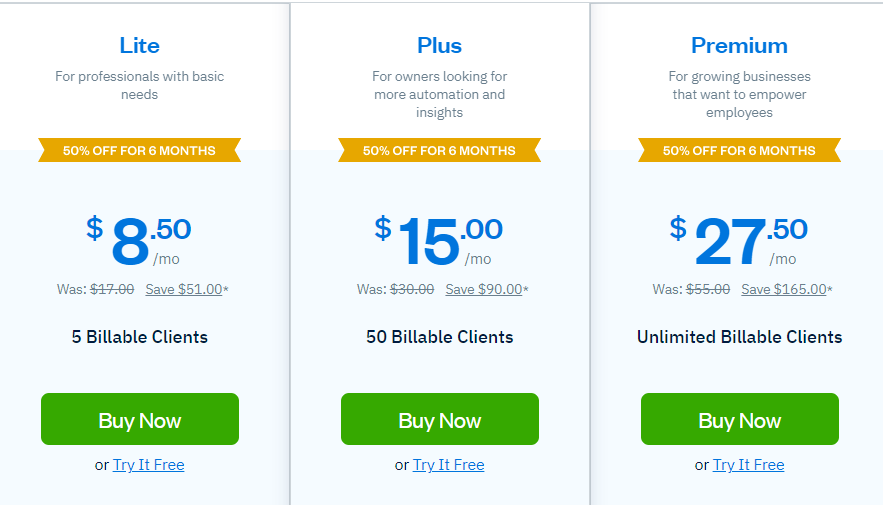

FreshBooks has 3 pricing plans to choose from: Lite, Plus, and Premium.

Lite This plan comes at a monthly cost of $8.50 and includes the following features.

- Create and send unlimited invoices

- Track up to 5 clients

- Accept payments online with Authorize.net

Plus, This plan comes at a monthly cost of $15.00 and includes all the features from Lite, plus:

- Track up to 50 clients

- Get access to powerful insights & reporting tools

- Automate recurring billing for regular customers

Premium This plan comes at a monthly cost of $27.50 and includes all the features from Plus, plus:

- Track up to 500 clients

- Get access to advanced customization options

- Create estimates to send potential clients a quote for their project costs easily

7. AccountingSuite

AccountingSuite is a top accounting software solution tailored specifically for Amazon sellers and ecommerce businesses. It makes financial management, bookkeeping, and reporting simple.

With AccountingSuite, Amazon sellers can seamlessly connect their Amazon accounts to import and categorize transactions automatically. You can generate customized financial statements with one click.

Features:

- Auto-import Amazon transactions and reconcile accounts

- Create professional invoices and track expenses

- One-click financial statements and inventory reporting

- Accept online payments through Stripe and PayPal integrations

- Automate accounting workflows with 100+ app integrations

Pricing Information:

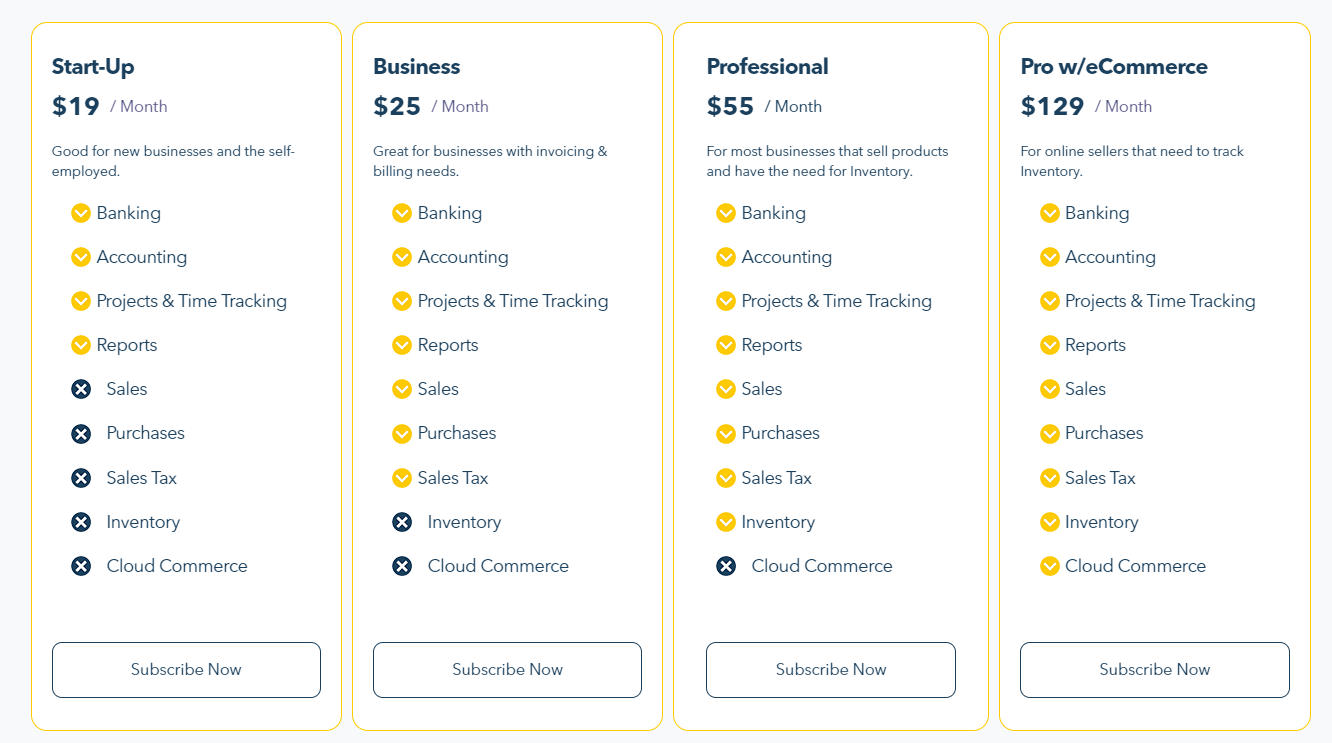

AccountingSuite has four pricing plans:

Start-up $19 per month with essential bookkeeping features

Business $25 per month adds advanced reporting and inventory management

Professional $55 per month includes a dedicated account manager and training

Pro w/eCommerce $129 per month includes ecommerce features and a dedicated customer success manager.

Related Read:

Summary: Best Accounting Software for Amazon Sellers

There you have it. Managing Amazon’s business is not easy, especially when you are fulfilling a bulk of orders daily. And you have enough time to dedicate to sales, product listing, and marketing. Using any of the Accounting Software mentioned above, you can streamline invoicing, billing, tax calculations, or even employee payroll management.

Here are some quick suggestions:

- If you are looking for accounting software and a comprehensive seller tool, Helium 10 is, without a doubt, the best option.

- GoDaddy bookkeeping is one of the most affordable accounting assistants out there. It’s perfect for freelancers.

- Quickbooks online is the best tool for tax calculations and deduction analysis. So if you are looking for a taxation-specific tool, you can opt for it.

Frequently Asked Questions

Importing Amazon sales into FreshBooks is a great way to keep track of your business finances. To do, thYou’ll connect your Amazon account with FreshBooks. Once c to do disconnected, you can import all of your Amazon orders and transactions automatically into FreshBooks. This will ensure that your data is up-to-date and organized in one place.

FreshBooks allows you to create various rules to automate your workflow and help improve your efficiency. For example, you can set up recurring invoices, automated payment reminders, and automatically categorize expenses. You can also set up rules that trigger notifications when certain activities occur.

The accounting software helps you track and manage your financial activities and maximizes your efforts, saving you an ample amount of time that you can use to increase sales.

Most accounting software provides a free trial for the users, but it’s for a limited time.

You can either hire a professional accountant or form an account team, depending on the size of your business. The easier and cheaper way is to use Amazon Accounting Software.

This is Wagner, an experienced Amazon FBA expert, and eCommerce enthusiast. With years of experience selling on Amazon, I got a wealth of knowledge to share with fellow sellers. In their writing, I cover a range of topics including Amazon FBA strategies, eCommerce trends, and online retail best practices.